What is Social Takaful?

Social Takaful is an Islamic-based inclusive protection scheme that promotes socio-economic fairness.

It operates by sustainably pooling risks among communities, benefiting the public at large through support and addressing societal needs. This approach adheres to the principles of mutual protection and mutual assistance (Ta’awun) among participants, based on ‘Aqad Tabarru'.

Why Social Takaful?

Despite the vital role life insurance and family takaful plays in financial stability,

Malaysia continues to grapple with a low penetration rate.

In 2015, Bank Negara Malaysia (BNM) indicated that only 35% of Malaysians own at least one life insurance or family takaful policy, where the B40 group has a mere 4% penetration rate. To combat this underinsurance issue, BNM set a target to reach 75% penetration rate in 2017.

Since 2020, several major social protection schemes have been initiated by the government, however despite the enormous investment of resources, the schemes encountered numerous challenges, hindering these schemes from fully achieving their goals.

Fast forward to 2023, the penetration rate reached 54% and 19% respectively for life insurance and family takaful, still falling short of the target. Ernst & Young further estimated that as of 2023, 90% of Malaysians remain underinsured.

We view these challenges as an exciting opportunity for innovation, and thus, the conceptualisation of Social Takaful started. Together with our partners, we think Social Takaful will change the game of social protection in Malaysia.

6 Implementation Pillars of Social Takaful

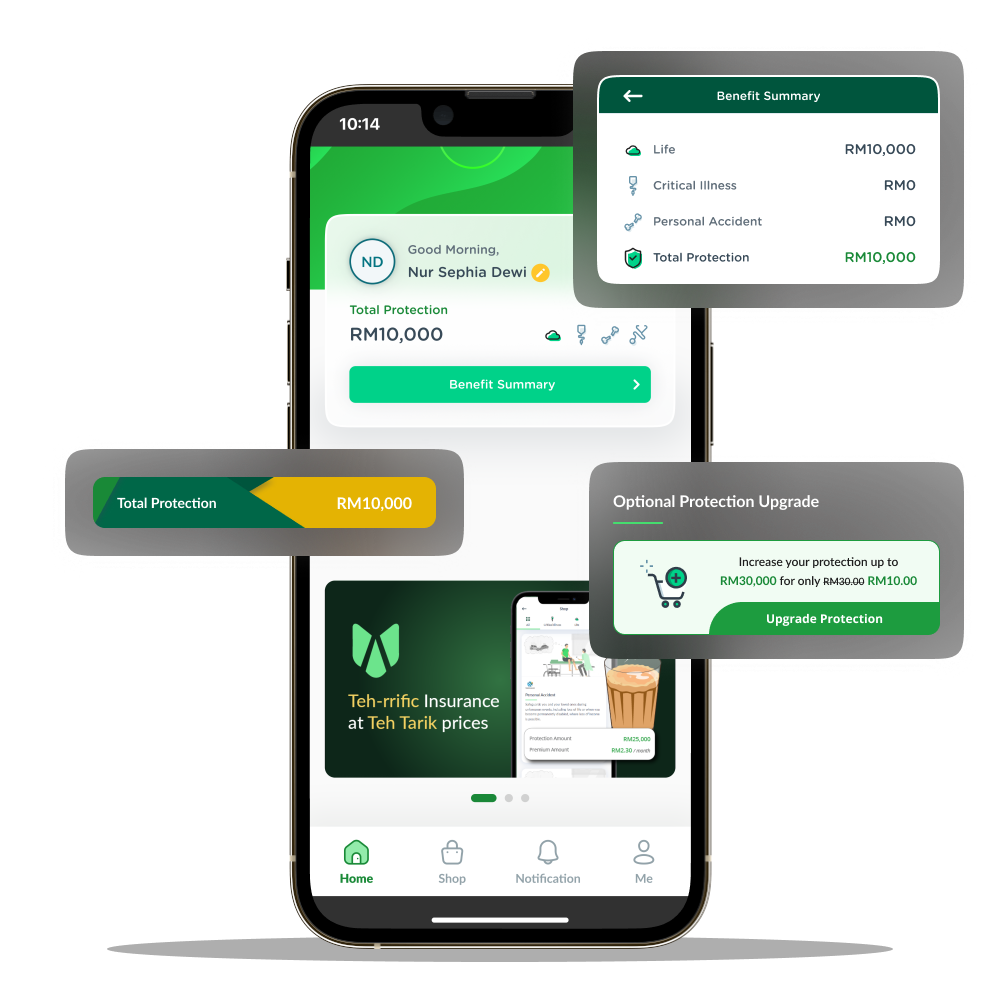

User Experience Design

Delivering frictionless end-to-end, single point digital user experience

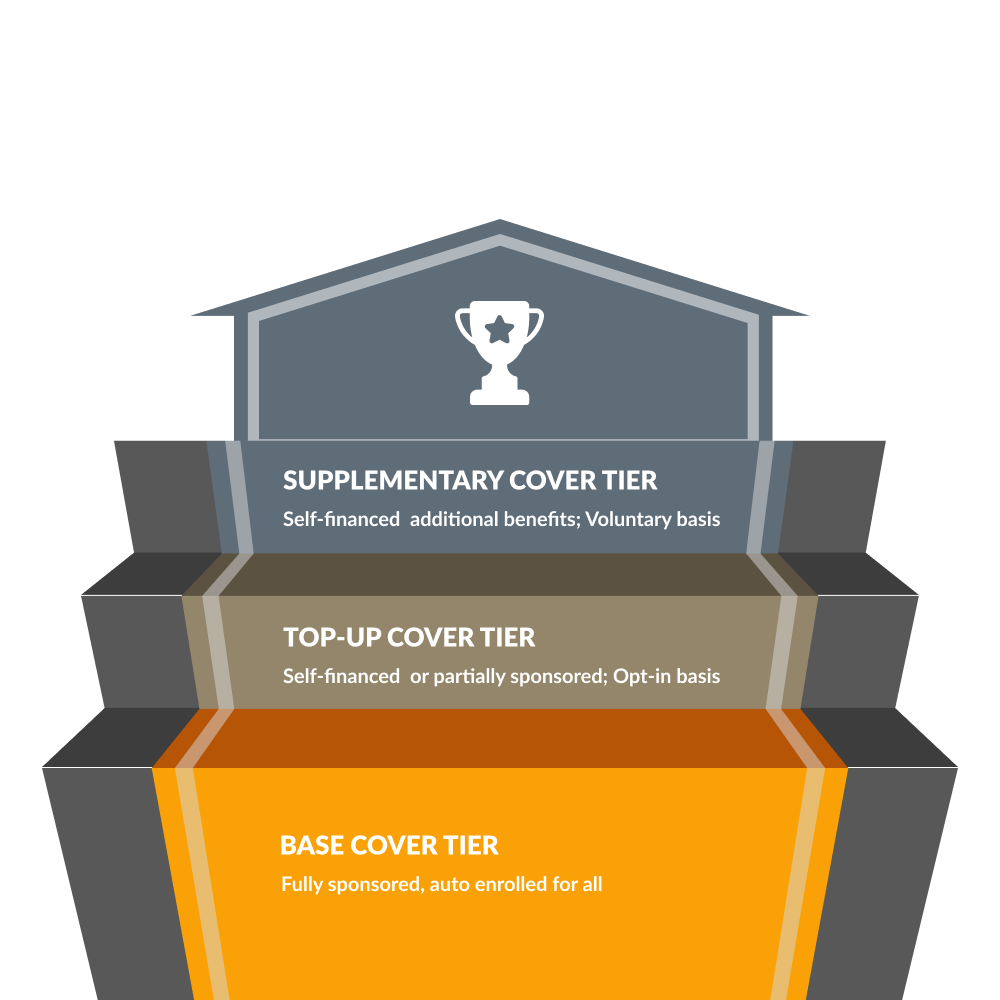

Benefit Design & Pricing

Flexible benefit structure to take on multiple streams of funding sources

Operational Integration

Seamless business operations and real-time data transfer between stakeholders

Governance & Regulatory Approvals

Ensuring operational efficiency of the takaful scheme and sustainability of takaful funds

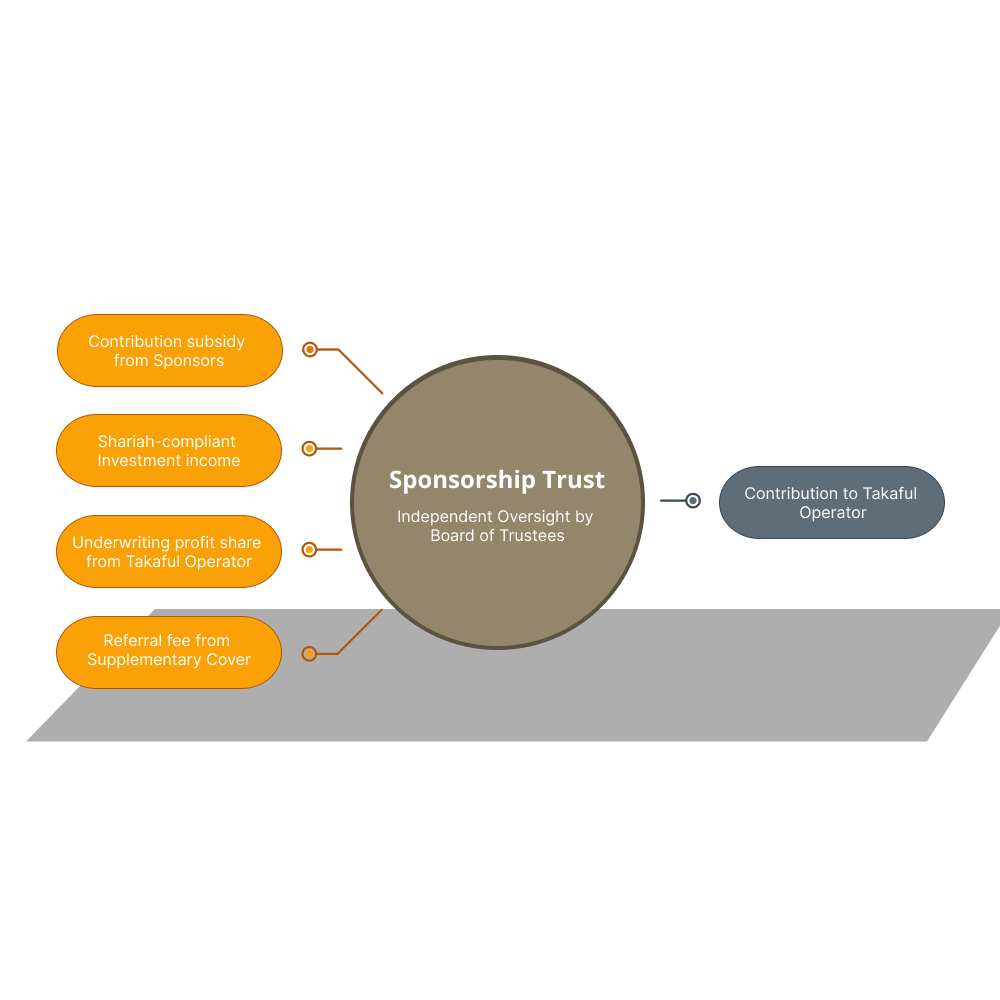

Sponsorship Trust Set Up

Committing to funding integrity, stability and sustainability